Fault vs. No-Fault Divorce in NJ

August 12, 2024

Can a Prenup include agreements about child custody or support?

August 26, 2024https://educationdata.org/student-loan-debt-statistics

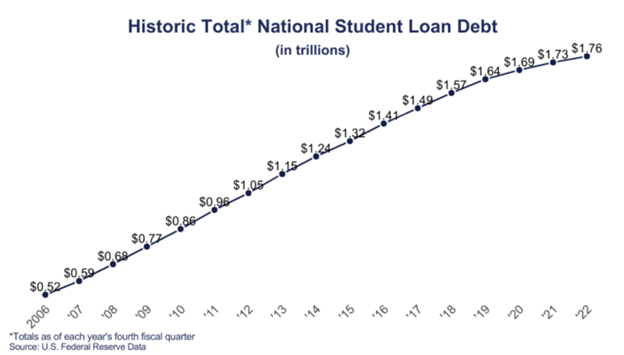

Student loan debt is a growing problem that shows no signs of slowing down any time soon. Student loan debt is the second-highest consumer debt category after mortgages and according to educationdata.org, 60% of 30-44-year-olds report student loan debt and borrowers between the ages of 25 and 34 years old hold an average student loan debt of $32,750.

To make matters more complicated, there can be a wide range of debt and interest rates between subsidized, unsubsidized, private, parent plus, graduate plus, and more.

New Jersey is an equitable distribution state, meaning that the court must divide assets, property, and debt accumulated in a fair manner. It is important to note that fair, in this context, does not mean equal. There are a number of factors that the courts take into consideration, and fault is not one of them. It is very rare that marital fault is even a consideration in equitable division decisions.

Let’s use this scenario as an example:

Brian and Ava get married. A short while after that, Ava goes to graduate school to earn her Master of Science in Nursing. While Ava is in school, Brian works full-time to support the household. Ava takes out $60,000 in student loans. After Ava graduates, she gets a job earning $150,000 per year.

Now, if the couple separates right after Ava graduates and the court is forced to allocate debt between the couple, the court would most likely decide that Ava is responsible for paying her student loans independently.

If the couple didn’t separate right after graduation, but stayed together another 10 years, then Brian would have benefited from Ava’s income for those 10 years. In that case, the court might divide Ava’s student loans making Ava responsible for part, and Brian responsible for some as well.

Essentially, the smaller the benefit Brian received from Ava’s education, the less likely he is to be required to contribute towards paying those loans.

In the above scenario, one of the most important factors was that Ava incurred the student loans after the couple were married. In New Jersey, mainly all property or debts acquired during the marriage are deemed as joint marital assets and debts.

If the assets are acquired or the debts are incurred before the marriage, there is more gray area and in the case of debts, courts are more likely to deem those as separate. That means that it is more likely that the person who incurred the debts will be responsible for paying them.

Looking at the Brian and Ava scenario, if they had gotten married during school, then the debt for the semesters before marriage would most likely fall solely on Ava and the debt from the semesters after marriage would be debatable, depending on the benefit Brian incurred from Ava’s education after graduation.

One common question we get is, “What if my partner had student loans before we got married, but then refinanced them after we got married?” In that case, the court might find that the premarital loans have been commingled and have become joint debt, or treat the refinance/consolidation as a new marital obligation since it occurred during the marriage.

Important Facts to Know:

- When did the parties get married?

- When was the student loan acquired?

- How was the student loan money spent?

- Who made the student loan payments during the marriage?

- Were the loans paid from a joint or sole bank account?

- Were the loans refinanced/consolidated during the marriage?

- Is there a prenuptial agreement?

There is a lot of nuance to student loan debt that has to be considered, as it can be much more complicated than shared credit card debt or a mortgage. A good rule of thumb is that student loans acquired before the marriage are typically separate, whereas student loans acquired during the marriage are marital debt. The court will look at the circumstances as a whole to try to allocate marital obligations as fairly as possible for both parties.

Call our experienced attorneys at 865-795-0020 to schedule a free consultation.

*This web site is designed for general information only. The information presented on this site should not be construed to be formal legal advice nor the formation of a lawyer/client relationship.